VALERO ENERGY CORP/TX (VLO)·Q4 2025 Earnings Summary

Valero Beats on All Metrics with Record Throughput, Hikes Dividend 6%

January 29, 2026 · by Fintool AI Agent

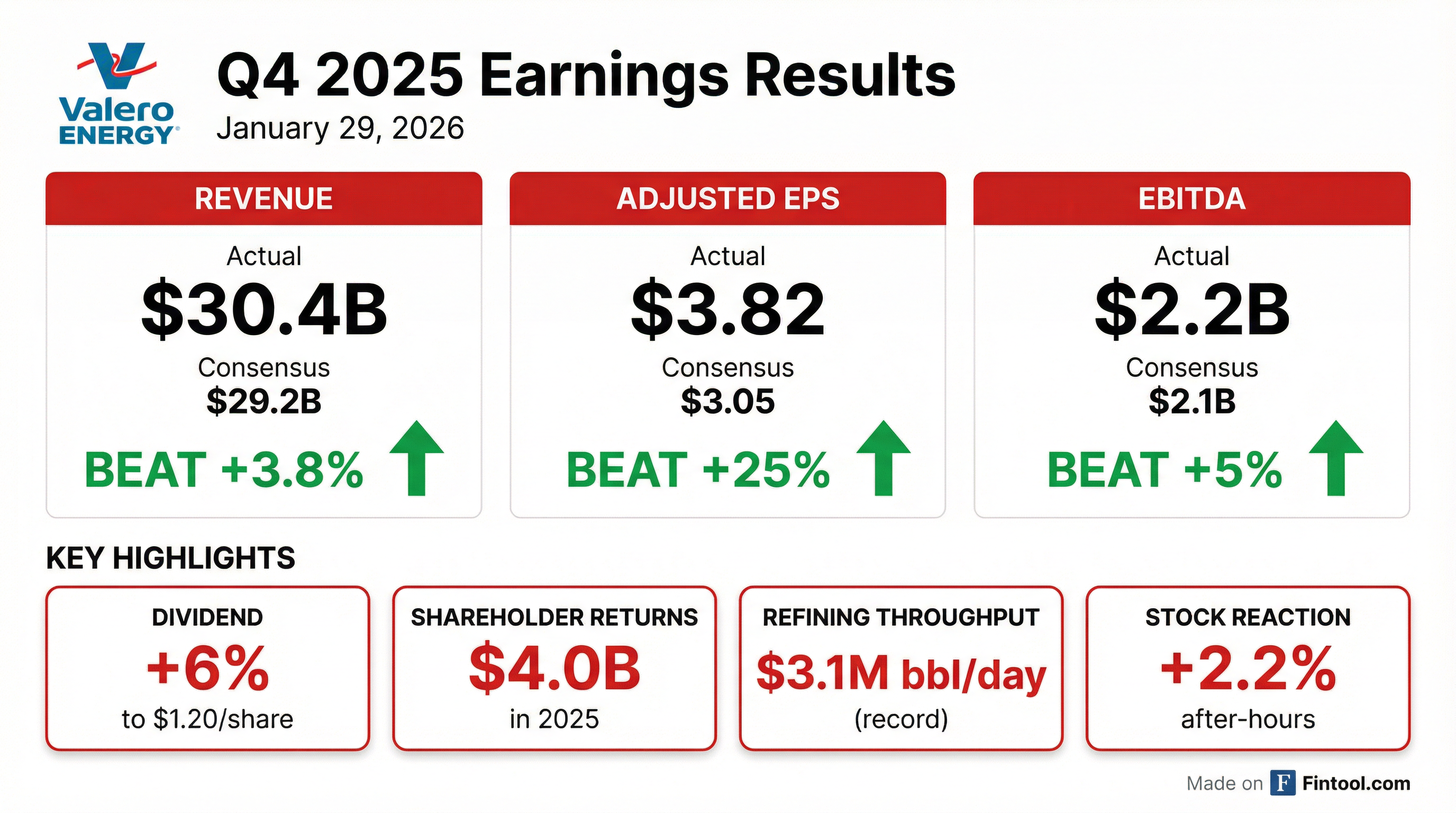

Valero Energy delivered a clean beat across all metrics in Q4 2025, reporting adjusted EPS of $3.82 vs. consensus of $3.05 — a 25% upside surprise — driven by record refining throughput of 3.1 million barrels per day and improved margins . The company achieved its best year ever for mechanical availability, personnel safety, and environmental performance, underscoring operational excellence that translated directly to financial outperformance .

Shares traded up 2.2% in after-hours to $187.00, as management announced a 6% dividend increase to $1.20 per share and highlighted $4.0 billion in total shareholder returns for 2025 .

Did Valero Beat Earnings?

Yes — a clear beat on all key metrics:

The EPS beat was particularly notable given Q4 2024's adjusted EPS of just $0.64 . The year-over-year improvement reflects a dramatic recovery in refining margins — Q4 2025 refining margin was $13.61/bbl vs. $8.44/bbl in Q4 2024 .

Full year 2025:

- Net income: $2.3B ($7.57/share)

- Adjusted net income: $3.3B ($10.61/share)

- Shareholder returns: $4.0B (67% payout ratio)

What Changed From Last Quarter?

The biggest delta was refining margin expansion and record throughput:

Key changes Q3 → Q4:

- Refining margin: $11.21/bbl → $13.61/bbl (+21%)

- Throughput: 2.99M bbl/day → 3.11M bbl/day (record)

- Operating income: $1.68B → $1.58B

The margin improvement was driven by wider crude differentials (Brent-WTI spread of $3.89/bbl) and improved product cracks, particularly in the North Atlantic region where margins reached $18.92/bbl .

How Did Each Segment Perform?

Refining (87% of operating income)

North Atlantic region delivered standout performance with 60%+ margin expansion YoY, benefiting from strong European crack spreads .

Renewable Diesel

Operating income of $92M (down 46% YoY from $170M) . Margins compressed to $0.82/gallon vs. $1.06/gallon in Q4 2024 — a headwind that management has been managing by adjusting production volumes based on economics.

Ethanol

Operating income of $117M (up 485% from $20M in Q4 2024) . Record production of 4.8M gallons/day and improved ethanol margins ($0.69/gallon vs. $0.42/gallon YoY) .

What Did Management Guide?

2026 Capital Investments:

- Total capex: $1.73B (including DGD JV partner share)

- Capex attributable to Valero: $1.70B

Key Projects:

- St. Charles FCC optimization: $230M project on track for H2 2026 startup, enabling higher yield of high-value products like alkylates

- Benicia Refinery: Refining operations to cease by end of April 2026

CEO Lane Riggs emphasized focus on operational excellence: "Valero's strong financial results and record operating performance highlight our operational and commercial excellence. We remain committed to our capital allocation framework that prioritizes balance sheet strength, disciplined capital investments, and shareholder returns."

What About California?

The California story continues to be a drag. In Q1 2025, Valero announced plans to cease refining operations at Benicia and recorded a $1.1B combined impairment loss for the Benicia and Wilmington refineries . Q4 2025 included:

- Incremental depreciation: ~$100M related to shortened useful life of Benicia assets

- LIFO liquidation charge: $37M as inventory levels decreased ahead of closure

- Employee retention costs: $50M for transition benefits

The U.S. West Coast region posted an adjusted operating loss of $162M ($89M for full year), though this is an improvement from prior quarters as the wind-down progresses .

How Did the Stock React?

- Previous close: $182.91

- After-hours: $187.00 (+2.2%)

- 52-week range: $99.00 - $194.35

VLO has been on a strong run, up 86% from its 52-week low. The stock trades at roughly 6x trailing adjusted EPS ($10.61) — a discount to historical averages that reflects the cyclical nature of refining and California headwinds.

Capital Returns & Balance Sheet

Valero remains a capital return machine:

Balance sheet at Dec 31, 2025:

- Cash: $4.7B

- Total debt: $8.3B

- Net debt/cap: 18%

- Adjusted operating cash flow: $6.0B for FY25

The 6% dividend increase signals confidence in sustainable cash generation even as the refining cycle normalizes.

Key Takeaways

- Clean beat — EPS, revenue, and EBITDA all exceeded consensus, with EPS surprise of +25%

- Record operations — 3.1M bbl/day throughput and best-ever safety/environmental metrics

- Margin recovery — Refining margins expanded significantly from trough levels

- Shareholder-friendly — 6% dividend hike, 67% payout ratio, $4B returned in 2025

- California exit on track — Benicia closure by April 2026, impairment already recognized

- Growth projects — St. Charles FCC optimization launching H2 2026

Q&A Highlights: What Did Analysts Ask?

Venezuela Crude Is Back — And Valero Is Ready

The most discussed topic on the call was Venezuelan heavy crude reintegration. Valero has historically been the largest U.S. purchaser of Venezuelan heavy crude, running up to 240,000 bbl/day pre-sanctions . With the new Port Arthur coker (2023), capacity is now "substantially north" of that number .

"We've already engaged with the three authorized sellers of crude, and we've purchased barrels from all three. So we anticipate Venezuelan crude making up a pretty large part of our heavy diet as we move into February and March." — Randy (Commercial)

Current crude differentials are favorable:

- Heavy Canadian in Gulf Coast: $11-$11.50 under Brent (vs. ~$7 in Q4)

- Mars: ~$5 discount to Brent (vs. ~$4 in Q4)

- Freight rates: Up ~30% from Q4, pushing discounts wider

Renewable Diesel: 2026 Should Outperform 2025

Management expects renewable diesel to improve in 2026, driven by several factors :

- Production Tax Credit (PTC) capture: Valero/DGD was first to figure out PTC optimization in H2 2025

- Competition sidelined: "Lot of capacity offline... players sitting out waiting for guidance"

- Fat prices declining: Lower feedstock costs as competitors exited

- SAF commercialization: Full sustainable aviation fuel production ramping

"What I see in 2026 is policy should be a tailwind... 2026 starting off more like the second half of 2025. That would indicate a stronger year in 2026 versus 2025." — Eric (Renewables)

Risk: Tariffs on foreign feedstocks and imports remain a potential headwind .

Ethanol: E15 Waiver Potential + PTC Upside

Ethanol continues to outperform, and Valero is positioned for additional upside :

- All plants registered for E15 — Ready if/when national E15 waiver passes

- PTC qualification: Plants set up for prevailing wage and qualified sales requirements

- Potential benefit: $0.10-$0.20/gallon PTC (works in $0.10 increments)

- Corn crop: Two consecutive years of cheap feedstock supporting margins

West Coast: Benicia Process Units Idling in February

Management provided more granular detail on the Benicia closure timeline :

- February 2026: Process units being idled for mandatory inspection requirements

- Fuel production continues: Working down inventory through the process

- Imports incoming: Gasoline and/or blend components to meet supply obligations

- Coordination: Working closely with California CEC and governor on supplemental supply

- Wilmington: Normal operations continuing

CapEx impact: Sustaining capital expected to fall ~$150M annually post-closure .

Labor Exposure: Less Unionized Than Peers

When asked about USW labor contract negotiations (Marathon-led), Lane Riggs noted Valero's competitive advantage :

"One of the advantages that Valero has versus our competitors... is we're less unionized directionally than a lot of the other people in the space."

Management declined to disclose specific refinery exposure but emphasized preparedness.

Market Outlook: Constructive Despite Inventory Builds

Despite significant Q4 inventory builds (moved from below to above 5-year average), management remains constructive :

Demand signals:

- Gasoline sales: Flat YoY in Q4

- Distillate sales: +13% (customer mix shift)

- Exports: Up both QoQ and YoY

- Diesel arb to Europe: Open

- Latin America demand: Strong for both gasoline and diesel

2026 Supply/Demand:

- Net capacity additions: ~400K bbl/day

- Light product demand growth: ~500K bbl/day

- Management view: "A little more bullish than consultants"

"Execution risk remains high on a lot of those assumptions... Russian refining capacity, new capacity at nameplate, bio/renewable diesel comeback, no additional rationalization." — Gary Simmons (COO)

Capital Returns: Mid-Teens Buyback Returns Over 10 Years

CFO Homer Bhullar addressed buyback sustainability with the stock near all-time highs :

"You go back 10 years when the stock was trading around $50-$60. We've been getting that question ever since then. For what it's worth, our return on buybacks is above mid-teens over that 10-year period with where the share price is today."

Capital allocation priorities unchanged:

- Balance sheet strength (net debt/cap at 18%, below 20-30% target)

- Disciplined growth investments (minimum return threshold)

- Share repurchases (excess free cash flow)

What to Watch

- Venezuela crude volumes — Management expects "pretty large" share of heavy diet in Feb/Mar

- Q1 2026 throughput — Turnaround activity + weather impacts; guidance: 2.77-2.88M bbl/day

- Crude differentials — Heavy Canadian and Mars spreads currently wide; watch for sustainability

- RVO/SRE resolution — Key policy catalyst for renewable diesel and ethanol segments

- Benicia execution — Process units idling in February; imports supplementing supply

Related: VLO Company Page | Q3 2025 Earnings | Earnings Transcript